NEW YORK — Stocks edged higher Monday on Wall Street after a strong sales report from McDonald’s (MCD) offset concerns about the surprise resignation of Italy’s prime minister. Investors also waited for developments in crucial U.S. budget talks.

The Dow Jones industrial average rose 14.75 points to 13,169.88. The index traded within a narrow range of just 56 points throughout the day. The Standard and Poor’s 500 finished 0.48 point higher at 1,418.55. The Nasdaq composite ended up 8.92 points at 2,986.96.

McDonald’s rose 93 cents to $89.41. A key sales figure rose in November as U.S. customers bought more breakfast offerings and limited-time Cheddar Bacon Onion sandwiches.

Robert Pavlik, chief market strategist at Palm Beach, Fla.-based Banyan Partners, said the company’s strength was encouraging. McDonald’s, one of the 30 stocks in the Dow, was trading as high as $100 at the beginning of 2012.

The pickup in McDonald’s sales, he said, gave investors something positive to focus on as Italy’s sudden political turmoil sent a jolt through European markets.

adsonar_placementId=1505951;adsonar_pid=1990767;adsonar_ps=-1;adsonar_zw=242;adsonar_zh=252;adsonar_jv=’ads.tw.adsonar.com’;

Hewlett-Packard rose 36 cents to $14.16 and also helped push the Dow higher. The company’s stock has been battered the past two months following a weak earnings forecast and a public spat with the founder of Autonomy, a company it acquired for $10 billion last year.

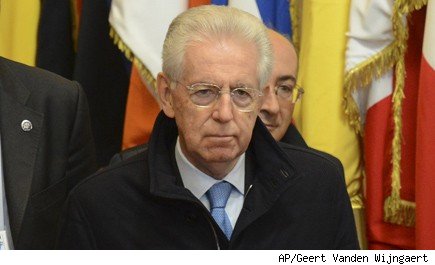

Italian Prime Minister Mario Monti, who has been credited with restoring confidence in the nation’s economy, announced that he would step down after former Prime Minister Silvio Berlusconi’s party dropped its support for his government.

Italian government bond yields, a critical measure of how much the country has to pay to borrow, jumped. Concern that the European debt crisis was enveloping Italy, one of the euro region’s largest economies, helped stymie markets around the world earlier in the year.

Investors were also following developments in budget talks in Washington. Tax increases and federal spending cuts start Jan. 1 unless a deal is reached to reduce the U.S. budget deficit. Economists say the measures, if implemented, could eventually push the economy back into recession.

The yield on the 10-year Treasury note fell 1 basis point to 1.62 percent.

President Barack Obama and House Speaker John Boehner met at the White House on Sunday while rank-and-file Republicans stepped forward with what they called pragmatic ideas to break the stalemate. The Obama-Boehner meeting was the first between just the two leaders since Election Day.

“There’s a pretty good belief that the ‘fiscal cliff’ can be avoided,” said Craig Johnson, a technical market strategist at Piper Jaffray. “Anytime somebody is talking, it’s a good thing.”

Other stocks making big moves:

• Priceline.com (PCLN) fell $33.14, or 5 percent, to $625.96 after Deutsche Bank cut its recommendation on the stock to “hold” from “buy” and lowered its price target to $710 from $800.

• Phillips 66 (PSX), the refining and pipeline company, gained $1.24, or 2.4 percent, to $53.58 after saying late Friday that it was raising its quarterly dividend to 31.25 cents per share from 25 cents. The company also said it had approved the repurchase of another $1 billion in company stock, after approving the repurchase of $1 billion during the first quarter.

• Intermec (IN), a maker of barcode printers and radio frequency identification products, jumped $1.85, or 23.2 percent, to $9.83 after it agreed to be acquired by Honeywell for about $603.4 million in cash.

• AIG (AIG) fell 74 cents, or 2.3 percent, to $33.36 after the insurer said late Friday that it will take $1.3 billion in losses related to Superstorm Sandy, more than other major insurance companies have reported so far. UBS said in a client note that AIG’s Sandy-related losses were above his estimate and cut his price target to $35 from $36.

Get info on stocks mentioned in this article:

MCD

AIG

IN

PCLN

PSX

Manage Your Portfolio

Copyright 2012 The Associated Press. All rights reserved. This material may not be published, broadcast, rewritten or redistributed.

Leave a Reply