#fivemin-widget-blogsmith-image-503634{display:none}.cke_show_borders #fivemin-widget-blogsmith-image-503634,#postcontentcontainer #fivemin-widget-blogsmith-image-503634{width:570px;height:411px;display:block}

try{document.getElementById(“fivemin-widget-blogsmith-image-503634″).style.display=”none”;}catch(e){}

try{document.getElementById(“fivemin-widget-blogsmith-image-503634″).style.display=”none”;}catch(e){}

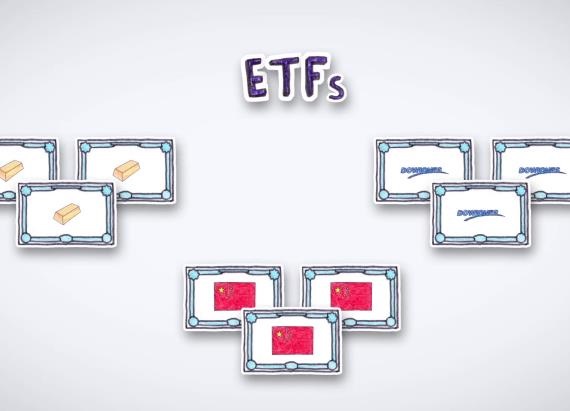

If you’re looking for an asset that’s as flexible as a stock with the diversity of an index mutual fund, the best investment option for you might be an exchange-traded fund.

A Relative Newcomer to the Market

The first ETFs were created in 1993, but they didn’t become popular until the early 2000s. ETFs track stock indexes, specific commodities, or other baskets of assets. So when you buy a share of an ETF, you’re investing in a (usually) diversified portfolio that tracks a particular commodity, industry or market, without dealing with the high costs and strict laws that are involved with buying all the individual assets separately.

ETFs are flexible (significantly more so than mutual funds), have low fees, and offer investors the option of owning as many or as few shares as they like, while still allowing access to a good chunk of the market. You can buy as little as one share of an exchange-traded fund, whereas other fund options require a significantly higher minimum investment.

The Best of Both Worlds

In some ways, ETFs look like mutual funds. But, like stocks, they’re extremely flexible. They combine some of the best things about both types of investments in one convenient package.

ETFs are similar to index funds in that they attempt to replicate the performance of a segment of the market. The goal of an ETF isn’t to “beat the market,” but to mimic the yields and returns of the index or assets it tracks. They’re a great way to diversify a portfolio, and an especially good choice if you favor a “passive management” approach.

It’s easy to trade an ETF: Like stocks, you can buy and sell them at any time during market hours on an open exchange. Prices are constantly updated throughout the day, so you have the option of trying to sell short or on margin. That’s not possible with mutual funds, which are priced once a day, at the close of trading.

In addition to offering some of the best features of stocks and index funds, ETFs are also great for tax-savvy investors. They’re low-fee investments, and investors usually aren’t taxed on their gains until they’re sold. Thanks to their structure, the capital gains tax hit you’ll take on an ETF is often less than it would be with a similarly targeted mutual fund.

A Great Option for Average Investors

To sum up, ETFs offer a cheap and easy way to invest in sectors of the market that might otherwise be inaccessible to retail investors because of their high costs, or because they require specialized knowledge to get started. That makes them a great way for an average person to get into the market — and explains their ever-growing popularity.

Nearly one in four people say they don’t have money to contribute to retirement after all the bills are paid. It might feel that way sometimes, but if we can find the $50 to go out to dinner every Tuesday night, we can find $200 a month to put in a retirement account. Make this happen, even if you have to do it one dollar at a time over the course of the month.

And if you think putting away $50 a week won’t make a difference, consider this: Contribute just $200 a month for thirty years, and if your money grows on average 8% a year, your total contributions of $72,000 will grow to almost $300,000 if put away for 30 years. When you think about it that way, skipping that regular Tuesday dinner doesn’t seem so bad, does it?

Excuse 1: I can't afford it.

This is one of the most seductive retirement lies. For a good long while, it is true that retirement is a ways off. (Even if you’re 55, it’s still at least ten years away.) But the longer you put off saving for retirement, the less interest you’ll earn and the more difficult it will be for you to save.

An example: Alex and Jordan both put just over $90,000 in their retirement accounts over the years, but Alex began saving ($2,000 per year) at age 22, while Jordan began saving (about $3,500 per year) 20 years later at age 42. Even though they both put in the same total amount, Alex will have over twice as much money at retirement as Jordan will when they reach age sixty-seven (assumes a 6% annual rate of return). That’s because her money had more time to grow, so it was able to make more off of itself than Jordan’s.*

Seriously, you have two people who put the same dollar amount into their retirement funds. The one who started twenty years later contributed the same amount, but ended up with less than half as much.

As someone who cares about making my money work for me, this speaks volumes. It turns out that one of the smartest things you can do is simply to get time on your side. This is how you shortcut the hard work-by taking advantage of the power of compounding interest and the fact that you will only have an increasing number of financial obligations pulling at your purse strings as the years go by. So, this is not something you can keep putting off. This is something to tackle today. The time is now.

Excuse 2: I'm young. There's plenty of time to save for retirement later.

I bet all the married people reading this are having a good laugh right now. Marriage does not automatically make your financial life easier. The effect of marriage on your finances depends on a host of factors: Do you both work? Do you both make enough to support yourselves? If one or both of you got laid off, could you still afford your rent or mortgage? Are you honest with each other about your spending? Do you agree on your financial goals? Will you have children? If so, do you make enough that one of you can stay home with them? Bottom line: This is an outrageous excuse, and now I am drinking wine.

Excuse 3: When I get married someday, I won't have to worry about money.

Maybe today’s retirees can say this. But the future of Social Security is uncertain. Anyone retiring in the coming years should not rely on this as a be-all and end-all. If the system doesn’t go bankrupt and you get to plan B? I don’t know about you, but that’s a risk I won’t take.

Excuse 4: What about Social Security? I'll just live off that when I retire.

I hear you. But saving for retirement versus enjoying life now is not an either/or proposition. You can do both. Also, let me put it this way: Yes, you deserve to enjoy

your money now, but you also deserve not to count pennies when you’re old.

Excuse 5: I deserve to have fun with my money today-I work hard for it.

This is a case of counting chickens before they hatch. You never know what could happen to the inheritance (it could be devoured by medical bills, it could dwindle away in a financial crisis, or you may need it to pay off debts or taxes of the estate). Sure, it would be nice to inherit a windfall and be able to put it toward your retirement, but counting on doing so is not a plan-it’s a gamble at best. It’s far safer to plan to fund your own retirement and then enjoy your inheritance as a bonus if you do indeed receive one.

Excuse 6: An inheritance is coming my way someday.

Yes, the market is unreliable from year to year, and yes, the value of your investments will dip in a down market. But downswings don’t last forever, and historically, over long periods of time, the market has shown solid returns. While past performance doesn’t reveal future returns, the S&P 500, for example, has averaged 9.28% annual returns over the last 25 years.

Alternatively, let’s say you leave your money under your mattress or even in a savings account bearing 1% interest: You’re going to lose the purchasing power of those dollars due to inflation (which is estimated at 3%). Yes, with the market, you’re opening yourself up to some risk — but with risk comes reward.

Excuse 7: The market is down, so why bother to invest in a retirement account?

No one can predict the market. No one. So while it’s true that you cannot time your investments perfectly so that they only ever go up, history has shown that if you invest regularly over decades, your investments should experience more ups than downs. So invest for the long haul, and don’t fret over minor dips now. If you do, you’ll be missing out on an opportunity to amass money later.

Excuse 8: I'll start saving when the market improves.

Sure, selling your home will free up lots of cash … but then where will you live? And what if the market is down when you want to sell that home? Remember the housing crisis a few years ago? The one where tens of thousands of near retirees were left without nest eggs after the values of their homes plummeted? This is not your smartest game plan.

Excuse 9: I'll be able to use the equity in my home to retire.

Yes, college is a big expense, and you should definitely save for it-that is, once your own retirement needs are taken care of. If you’re a parent, it’s a natural instinct to put your children’s futures before your own. But think about it this way: If you don’t save the full amount for your children’s college education, you can always fall back on financial aid, grants, scholarships and student loans to help pay your children’s way. When it comes to your retirement, however, there are no loans. Let me repeat: There are no loans. All you’ll have to live on is what you’ve saved. For that reason, saving for retirement should be your top financial priority-always. I get that you don’t want to saddle your kids or future kids with loans- what parent would?

But remember that if you pay for your children’s college and then cannot afford your retirement, you will end up burdening your children all the same. They will feel obligated to help you out-at a time when their own families need them financially.

Excuse 10: I need to get my kids through college first, and then I can focus on my retirement.

You may love your work, and it may be the kind of work you can even imagine yourself doing well into your seventies or eighties. But while that’s easy to say now, what if you can’t find work at that point in your life, or what if you have health problems or family obligations that prevent you from working? While there is nothing wrong with hoping for a best-case scenario, it isn’t wise to plan around one. Sock away some money now so you’re ready for whatever may come your way. The last thing I ever want you to deal with is a health issue and money concerns at the same time.

Excuse 11: I plan to keep working even during retirement.

11 End-of-Year Tax Questions to Ask Yourself Now

8 Money Habits That Are Holding You Back

How to Make a Financial Comeback: 3 Real-Life Tales of Resilience

More from LearnVest:

Leave a Reply