I recently met with an Indian couple to review their investment portfolio. They are in their 30s and work as engineers in the U.S. They had just returned from visiting their families in India with $20,000 worth of ornamental gold and showed me pictures of the beautiful jewelry.

We then turned to their investment portfolio, which also contained gold — but in the form of the SPDR Gold Shares exchange-traded fund (GLD). It was launched in 2004 to lower many of the barriers — such as access, custody and transaction costs — of investing in gold. Let’s use my clients’ visit to consider three key three questions about gold:

1. Why Would I Invest in Gold?

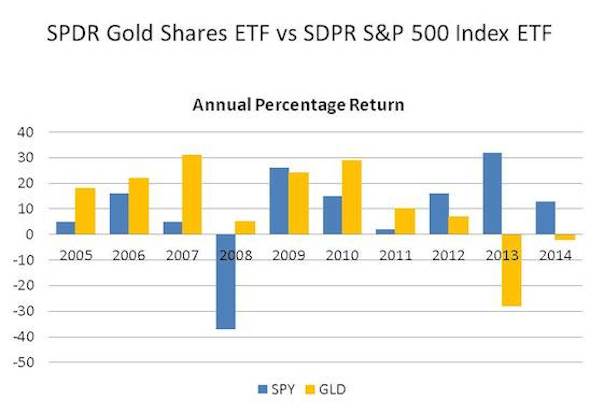

Diversification is the key to successful long-term investing. Let’s say you have always invested your money solely in large-cap U.S. stocks. While in 2013 and 2014 you would have enjoyed excellent annual returns, in 2008 you would have been yelling at your financial adviser (or yourself). You could have avoided a total meltdown in your portfolio in 2008 had gold comprised part of your portfolio. The price of gold and stocks are not directly correlated, which means you can own something that is going up in value while the other is going down in value. This chart compares that gold ETF with the SPDR S&P 500 ETF that tracks the S&P 500 Index (^GPSC). It shows that during most years between 2005 and 2011, gold returned a much higher percentage than stocks. And in 2013, when U.S. stocks had their best year since the mid-’90s, the price of gold plummeted.

鈥嬧€婥urrently the U.S. dollar is very strong relative to other currencies, such as the euro and the yen. As the dollar has strengthened, the price of gold has fallen. Should the dollar reverse course or even collapse due to domestic or global turmoil and instability, many investors would likely flee to gold, which would increase the demand and subsequently the price. Gold has historically been perceived as a safe-haven asset as it is held by central banks around the world.

2. Is Now a Good Time to Buy Gold?

Each investor has a different time horizon and risk tolerance, and no one can consistently call the bottom of a market. Only you or your financial adviser can decide if now if the time to add gold to your portfolio. Some traders wait to buy an asset until the price trend shifts from flat or negative to positive. That happened last week in large part due to the surprise move by the Swiss central bank to end its cap on the Swiss franc’s value against the euro, which led some investors who had valued the franc for its stability to shift over to gold. Gold prices went up on the news.

3. Why Should I Buy an ETF Instead of Physical Gold?

Sure, you could keep gold bars or coins at home or bury them in your yard. Any other option will cost you money for storing the gold — such as buying a safe or renting a safety deposit account at a bank. I prefer to invest in gold using ETFs, which have fairly low annual expense ratios and give me the ability to sell immediately, as they trade like a stock rather than finding someone to buy my gold.

Two of the most heavily traded gold-oriented ETFs are SPDR Gold Shares and Market Vectors Gold Miners (GDX), although there are many from which to choose. The share price of GLD closely matches changes in the price of spot gold, while GDX invests in shares of the largest gold mining companies from around the world. Some investors prefer investing in a fund that is directly impacted by changes in the price of gold but also generates dividend income from the companies within the fund.

A benefit of choosing heavily traded ETFs is that options are traded on them, which enable investors to reduce risk when investing in gold. For example, let’s assume an ETF called XYZ is trading at $23 per share. I’d like to put an order in to buy 100 shares only if it falls to $22 per share. Most people would use a limit order to accomplish that. But if you sold a put option instead, you could be credited with immediate income in your account in exchange for agreeing to buy 100 shares at $22 sometime in the future. It is less risky than buying XYZ outright because if XYZ falls in value after you purchased it, you received income from the sale of the put option which would offset some of your loss. I call this strategy, “Getting paid to wait to buy stock on sale,” and I explain the benefits of this strategy and how you can execute it yourself in chapter 7 of my book, “Every Woman Should Know Her Options.”

Most employer-provided retirement plans offer mutual funds that don’t include exposure to gold, but you can easily (and inexpensively) purchase shares of an ETF within a brokerage account or self-directed individual retirement account.

.

•Is Your Financial Adviser Profiting At Your Expense?

•Easy, Last-Minute Move Could Cut Your Taxes by Thousands

•Spousal IRA Lets Nonworking Spouse Save for Retirement

Leave a Reply