With more than $2 trillion in mutual fund assets, Vanguard is one of the largest investment companies in the world, and it has acquired a reputation among bargain-seeking investors for its low fund costs. But recently, news broke that a former employee has sued Vanguard, alleging that the company’s methods for generating low costs violate federal and state tax laws.

Blowing the Whistle

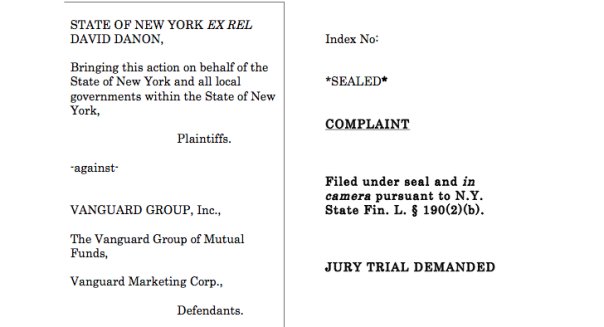

David Danon used to work as a tax attorney at Vanguard, and before he left last year, he filed a whistleblower lawsuit under seal to protect his identity. Recently, though, Danon arranged to have the court case unsealed.

Danon doesn’t mince words in his lawsuit. In the words of the original complaint, Danon alleges that “Vanguard has operated as an illegal tax shelter for nearly 40 years” and in the process avoided paying $1 billion in federal income taxes and at least $20 million in New York state taxes over the past decade.

The gist of Danon’s argument is that Vanguard hasn’t properly accounted for internal transactions between its funds and Vanguard’s management services providers. Rather than charging market rates to manage its funds, Vanguard instead provides those services at cost. That strategy minimizes Vanguard’s taxable income and thereby allows it to pay relatively little in federal or state taxes.

For Vanguard’s part, the fund company has long touted its at-cost structure as a benefit to its customers. As it describes the arrangement, Vanguard is entirely owned by its shareholders, with investors not only owning shares of the mutual funds themselves but also holding a stake in Vanguard’s management operations as well. From one perspective, therefore, it shouldn’t matter what Vanguard charges in management fees, as any “profits” would go back to its investor-owners.

For the Internal Revenue Servicre and state income tax agencies, however, the legalities of the at-cost arrangement are more complicated.

The Intricacies of Tax Law

In the corporate tax world, transactions between related companies happen all the time, and tax laws are designed to ensure that large corporations don’t use internal subsidiaries to hide what would otherwise be taxable income in a transaction between unrelated business entities.

International tax law is one big area where these issues usually come up. For instance, a U.S. company might set up a foreign subsidiary in a low-tax country and run certain transactions through the subsidiary. In this case, it makes the most sense for any profits to appear in the foreign subsidiary, because it pays lower taxes than the U.S. parent company. Controversy about that practice has led to calls for reform of international tax laws, especially in light of the recent trend toward inversions — having entire major U.S. corporations relocate their tax homes to foreign countries to qualify for lower corporate tax rates.

Vanguard says that it believes the case is without merit, and it defends its ethical standards and the benefits of its unique corporate structure. Yet the stakes are unquestionably high.

Nibbling Away at BlackRock

Vanguard isn’t the largest fund company in the world, but it has grown quickly in recent years, and its low-cost reputation has been the foundation of its popularity for many investors. In the fast-growing exchange-traded fund market, industry leader BlackRock has seen Vanguard eat away at its market share, forcing it to cut fees to compete. Even the suggestion that Vanguard has reaped cost savings compared to its competitors as a result of improper tax practices could give BlackRock an opening to reverse that trend.

The big question for Vanguard is whether Danon’s lawsuit will prompt a broader investigation. With the New York attorney general’s office having chosen not to seek prosecution against Vanguard, it’s possible that the fund giant will emerge unscathed from the allegations.

Nevertheless, Vanguard fund investors should keep an eye on the lawsuit as it progresses to see if the structure that has saved them so much in costs is in jeopardy.

•What You Need to Know About the New Mortgage Rules

•Your Midyear Guide to Managing Your Money

•4 Ways to Beat Soaring Baggage Fees

Leave a Reply