LONDON — As the summer driving season ends, U.S. gasoline prices have fallen to the lowest level for the time of year since 2004, wiping out the effect of more than a decade of rising fuel bills.

The average retail price of gasoline across the United States was just $2.53 a gallon Monday, including federal, state and local taxes, according to the U.S. Energy Information Administration.

Retail prices have fallen by $1 a gallon, approximately 30 percent, compared with the same time last year and haven’t been this low at the end of the driving season since 2004.

Gasoline prices are seasonal, reflecting higher demand in summer than winter and the limited capacity of the refining system.

Over the last decade, gasoline prices have generally fallen on average by 50 cents a gallon between the close of the driving season and the end of the year.

If that pattern is repeated, average gasoline prices could finish the year around $2 a gallon, which would again be the lowest in nominal terms since 2004.

On the West Coast, fuel remains relatively expensive, owing to problems with the region’s refineries, which have left gasoline stocks unusually low.

But in the rest of the country, fuel is comparatively cheap and prices are sending a strong signal to consumers that it is okay to use more of it.

Economic expansion and rising employment are also boosting driving but cheaper fuel is turbo-charging fuel consumption.

Demand Responds

In response to lower gasoline prices, motorists are using their cars more and buying larger vehicles which offer more power and more space but get fewer miles a gallon.

Statistics on gasoline consumption, traffic volumes and auto sales all tell a consistent story about strongly rising demand.

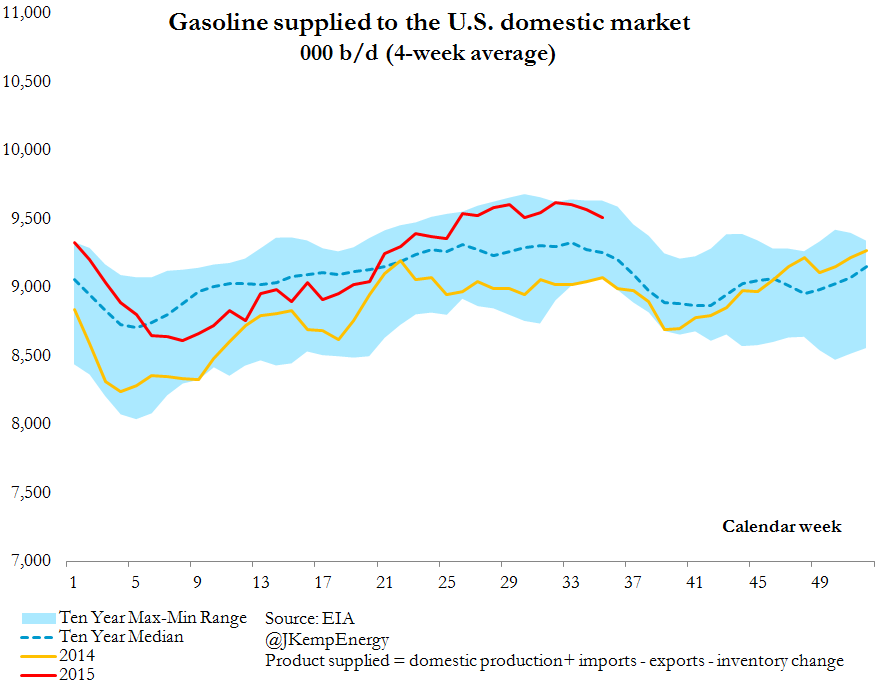

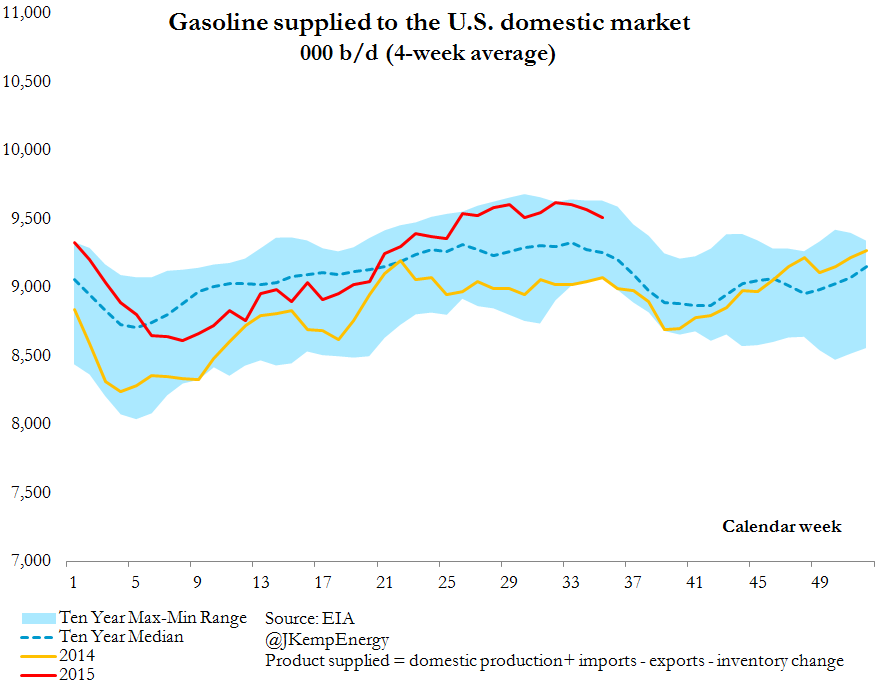

Gasoline consumption averaged 9.5 million barrels per day during August, according to the EIA, the highest seasonal level since 2007.

As the summer drew to a close, consumption was up by around 400,000 bpd, about 5 percent, compared with 2014.

The volume of traffic on U.S. roads is also rising fast, and the increase is apparent in states as diverse as New Hampshire and Florida.

Florida’s traffic rose by almost 3 percent in the first six months of 2015 compared with the same period in 2014, the fastest increase since 2005, according to the state department of transportation.

New Hampshire’s traffic was up by around 2.5 percent between January and July compared with the same months in 2014, the fastest increase in more than a decade.

Motorists are also buying larger, more fuel-hungry vehicles. Car sales were up by 2.7 percent in August compared with the prior year but light truck sales surged 5.5 percent, according to Wards Auto.

For the first eight months of the year, car sales actually edged down slightly while truck sales soared by almost 10 percent, according to Wards.

International Sales

In general, traffic volumes and fuel sales are more closely related to macroeconomic variables like income and employment rather than fuel prices (“Dynamic demand analyzes for gasoline and residential electricity” 1974).

But the drop in fuel prices over the last 12 months has been so large it is having a measurable impact on both the type of vehicles motorists are choosing and the amount they drive.

As the driving season ends, traffic volumes and fuel consumption volumes will slow seasonally through the end of the year.

But the structural increase in demand from larger vehicles and more usage will continue to boost fuel consumption compared with prior year levels.

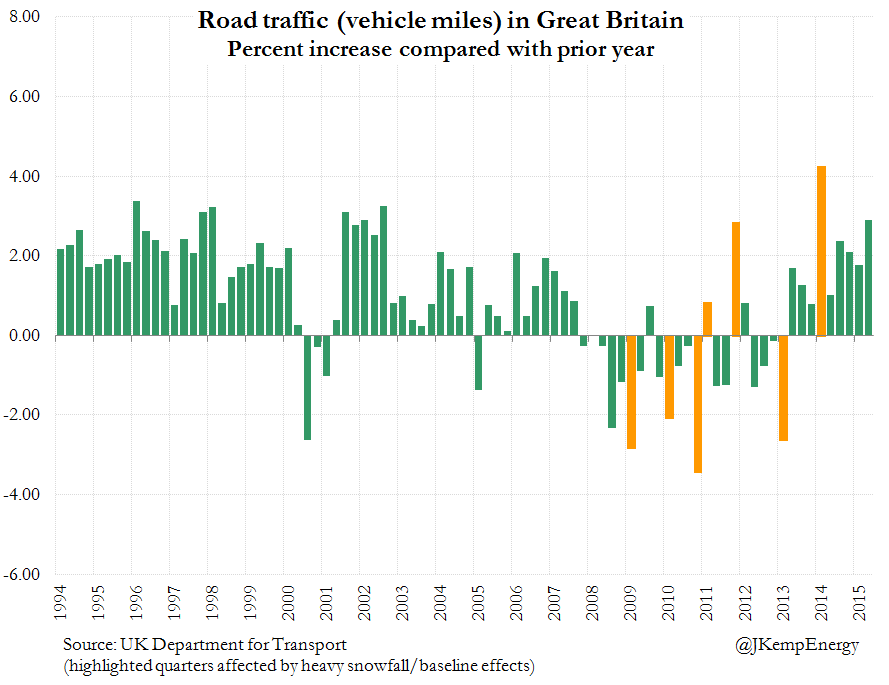

Moreover, it isn’t confined to the United States. Traffic volumes and fuel consumption are also growing rapidly in Britain, according to the U.K. Department for Transport.

Most OECD countries tax fuel much more heavily than the United States so changes in the cost of crude oil have a smaller percentage impact on the final cost of fuel.

Heavy fuel taxes make consumption even less responsive to changes in oil prices than in the United States. But the drop in fuel prices over the last 12 months has been so large it is having a measurable impact even in high-tax countries.

Traffic on Britain’s roads increased almost 3 percent in the second quarter compared with the same period in 2014, the fastest increase since 2002 (excluding periods affected by unusually bad weather).

Low fuel prices are stimulating the fastest growth in rich-country oil demand in a decade which will gradually help force the oil market back into balance.

()

•Wall Street Rallies on Fed Rate Hike

•Fed Raises Interest Rates, Cites Ongoing US Economic Recovery

•US Aerospace Sector Poised for 2015 Record Trade Surplus: Group

Leave a Reply